One of our key activities over the past year has been the work on supporting public digital infrastructures. While most of it relates to how the EU can invest in public digital infrastructures to support digital public spaces and safeguard digital rights, we have also started to look at specific efforts to build such infrastructures. One such example is the European Commission’s proposal for a regulation to establish a Digital Euro published on June 28, 2023, which is now starting to make its way through the legislative process.

The proposal — published alongside a proposal for a regulation on the legal tender of euro banknotes and coins intending to ensure the continued existence of cash payments in the Eurozone — seeks to create the regulatory basis for the European Central Bank to issue a Euro denominated Central Bank Digital Currency (CBDC), the Digital Euro.

According to the proposal, the introduction of “a retail CBDC – the Digital Euro – is necessary to supplement cash and adapt the official forms of the currency to technological developments so that the euro can be used as a single currency, in a uniform and effective manner across the euro area.” (p.1) This is primarily justified by a diminishing use of cash which “puts at stake the desirable balance between central bank money and private digital means of payment. This trend could even be reinforced in the future, with the emergence of third country central bank digital currencies (CBDC) and stablecoins issued by private firms, which could challenge the role of the euro in payments, in the EU and outside.“(p.1)

Public Money = Public Infrastructure

Given this official rationale, most of the public discussion about the Digital Euro has been based on the perception that the Digital Euro is intended to replace cash as a means of payment. But looking at the proposal only in this way misses an important point.

With the proposal for the Digital Euro, the European Commission (and the European Central Bank as the entity that would carry out the work) are proposing to build a public digital payment infrastructure that will offer an alternative to the private digital means of payment (such as credit cards and other online payment services).

In a digital society where many transactions take place online, consumers need a public alternative to private digital payment methods that are too often coupled with invasive personal data collection and abuse. This is why a regulation to establish a Digital Euro is a welcome step towards the much-needed creation of a public digital payment infrastructure that can provide such an alternative and complement cash, which offers more privacy protections but cannot be used for many online transactions.

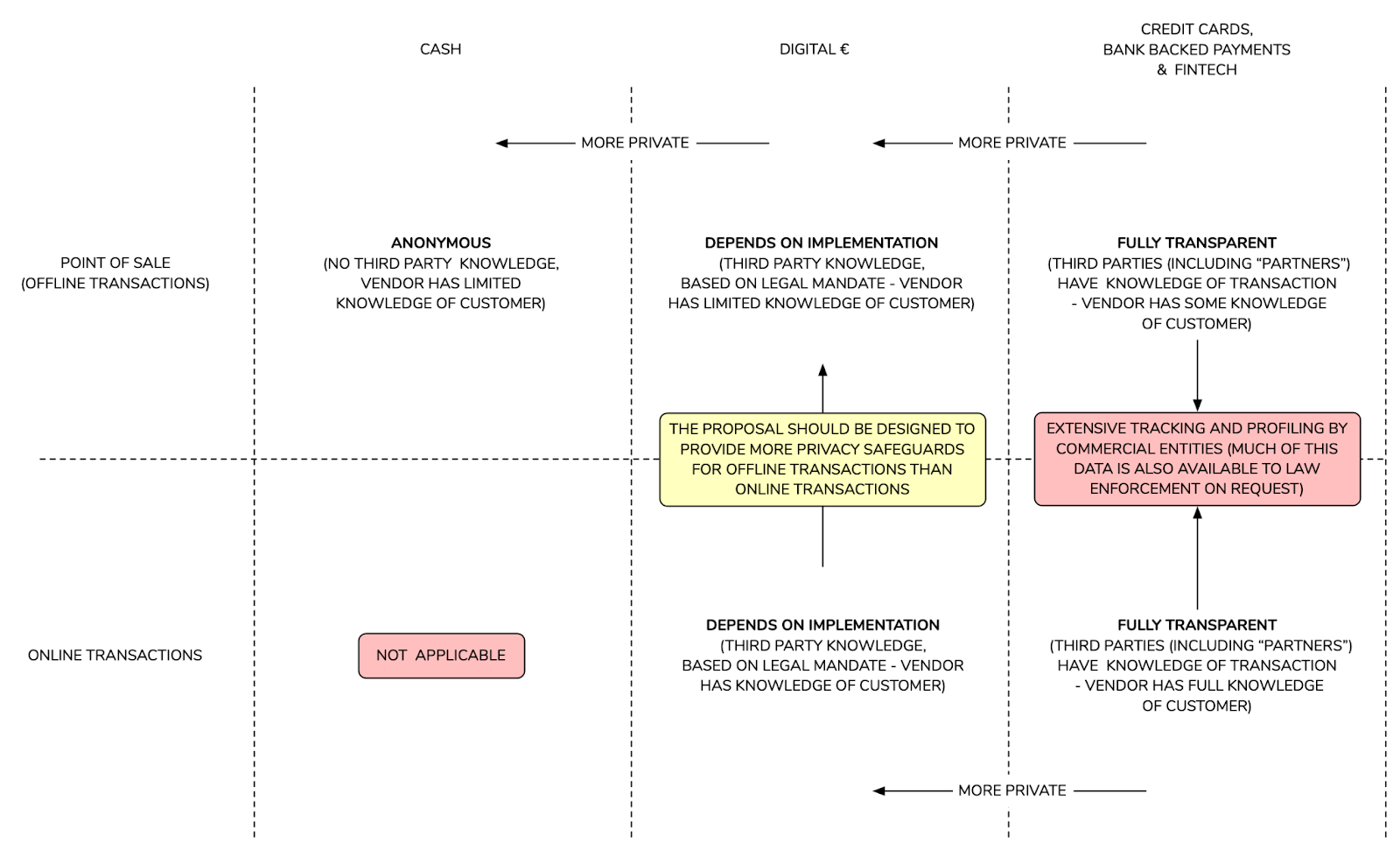

As shown in the illustration above, a Digital Euro that replicates key features of cash has the potential to be a major innovation for people living in the EU. But this is only the case as long as it meaningfully enhances the privacy of online payment transactions vis-a-vis the existing private digital means of payment. Europe needs a privacy-preserving, inclusive digital payment method that can be used by everyone free of charge.

But privacy is not the only consideration. In order to function as a public digital infrastructure, the digital payment infrastructure underpinning the proposed Digital Euro must meet certain requirements. This means that all key rules and design decisions underpinning the Digital Euro must be under the control of democratically legitimized public institutions and must have the interests of the people who use the payment infrastructure at their center. In addition, the core infrastructure underpinning the Digital Euro — i.e., the services and software used and provided by the European Central Bank and the other banks of the Eurosystem — must be developed as open source software in order to ensure transparency and avoid dependencies on external vendors.

Missing safeguards

Unfortunately, the Commission’s proposal is lacking in both aspects. It leaves key privacy considerations unaddressed, and it does not contain any meaningful requirements for the software infrastructure to be developed and deployed in line with established requirements for public digital infrastructure.

On privacy, the Digital Euro, as proposed by the Commission, leaves key architectural considerations to be decided by implementing and delegating acts outside of the democratic process. Those considerations need to be prescribed in the text of the legislative act itself. The current proposal provides no reliable guarantees for the user against pervasive tracking of their payments and has a privacy architecture that falls short of European data protection standards. Furthermore, the proposal makes it impossible for people to know in which concrete scenarios and by whom their payment data can be accessed. As a result, Digital Euro, as proposed, would have a privacy score closer to existing digital payment solutions like PayPal or Mastercard/Visa and would not provide a significant improvement for consumers seeking alternatives for these services.

Regarding the characteristics that would ensure the public character of the underpinning digital infrastructure, the proposal is similarly lacking. It should clarify that an infrastructure as critical as a central bank digital currency that functions as legal tender should never be built and operated as a proprietary and closed-source system by for-profit corporations. Instead, the Digital Euro proposal must ensure that the core infrastructure operated by the Eurosystem (i.e., ECB and central banks) is transparently developed and implemented based on free and open source software and open, patent-free standards.

Opportunities for improvement

Together with other EDRi members and with consumer organizations, we are currently working on formulating concrete suggestions for improving the Commission’s proposal to address the two issues we have identified above. A Digital Euro has the potential to become a democratic and inclusive alternative, provided it allows online and offline payments with limited identification requirements and strict limits on the storage and sharing of personal information. The Digital Euro can serve as an example of public digital Infrastructure based on democratic values that can give concrete form to Europe’s ambition to strengthen its digital sovereignty. These opportunities should not be missed.